One of the best reasons to incorporate your business as a limited liability company (LLC) is to be able to take advantage of the possible tax benefits. Forming an LLC is an important step to make your business “official” as a legal entity and protect your personal assets from some of the worst-case scenarios of owning a business, but your LLC also can provide some valuable advantages to help you save money at tax time.

If you are considering forming an LLC, or even if you already are doing business as an LLC, you should know about some possible tax implications.

LLCs Do Not (Usually) Pay Taxes

The first thing to understand about LLC taxes is that, unlike a C Corporation, an LLC generally does not owe corporate income taxes. You still have to file a business tax return for your LLC, but the company does not have to pay taxes on its own; your LLC is generally considered a “disregarded entity” or “pass-through entity” for tax purposes. This means that, unless you file certain forms and make specific instructions with the IRS, the money earned by the LLC simply “passes through” to the owners’ personal tax returns.

So how does forming an LLC help you save money at tax time? It depends on a few factors…

How Your LLC Can Save You Money on Taxes

The most important way that an LLC can help you save money at tax time is by reducing the amount of self-employment tax that you have to pay.

If you are a self-employed person who does not have an LLC or other legal business entity for your business and you file taxes as a sole proprietorship, you are required to pay both the employer and employee’s share of Federal Insurance Contributions Act (FICA) payroll taxes (Social Security and Medicare contributions that come out of every employee’s paycheck).

This means that you might have to pay self-employment taxes of 15.3 percent of the first $132,900 of your income (and 2.9 percent of any amount over that level).

Lots of new business owners don’t realize how big of a hit this self-employment tax might be. If you’re employed in a “regular” job, your employer pays half of this tax amount, and the remaining amount comes out of your paycheck. When you’re responsible for paying that full “double” amount of FICA taxes, it can feel like a big burden.

This is why forming an LLC can be so important for your taxes. It gives you the flexibility to choose a different tax treatment for part of your business income, which helps you minimize your self-employment taxes and free up money for other purposes.

How to make this happen? If you have an LLC, you can choose to have your LLC file taxes as an S Corporation.

Filing Your LLC Taxes as An S Corporation

S Corporations are different from C Corporations, because the S Corporation (like an LLC) does not have to pay corporate income tax. S Corporations are (like LLCs) also considered “pass-through” entities, which means the owners’ business income gets taxed on the owners’ individual tax returns.

When you set up your LLC to file taxes as an S Corp, you get the advantages of an LLC but with another level of flexible tax treatment for your income. With an S Corp designation, you can treat some of your LLC income as a salary that you pay yourself from the business, and the remaining amount of net business income is called a “distribution” or dividend. The business owner still owes FICA taxes on the salary, but not on the “distribution” income.

This special tax treatment for LLCs filing as S Corps can help you reduce your self-employment taxes.

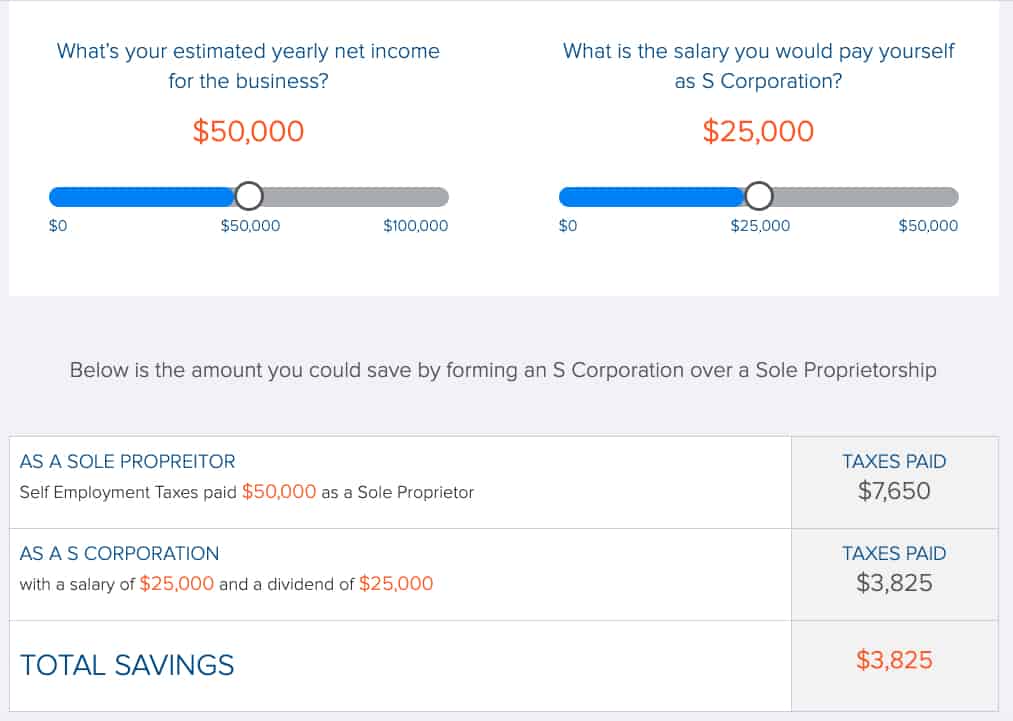

For example, as shown in these images, if you had business income of $50,000 and paid yourself a salary of $25,000 and a distribution (dividend) of $25,000, your total tax savings would be $3,825.

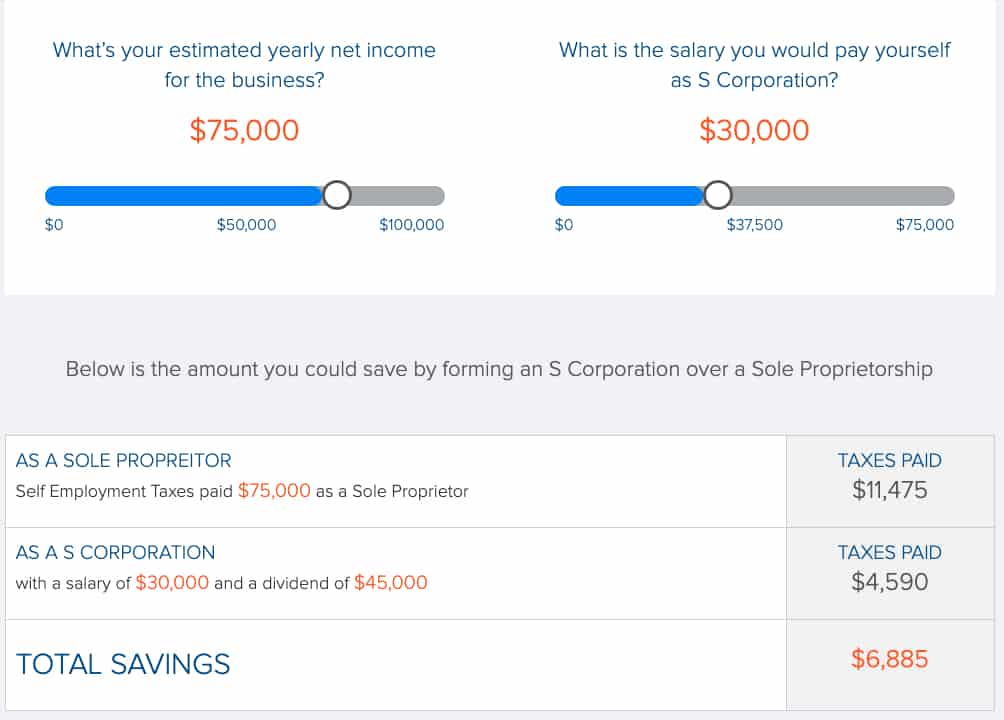

The tax benefits get bigger as your income goes up. For example, if your LLC filing as an S Corp had income of $75,000 and you paid yourself a $30,000 salary (taking the remaining $45,000 as a distribution/dividend), you would have a tax savings of $6,885 compared to what you would have paid as a sole proprietor with that same income.

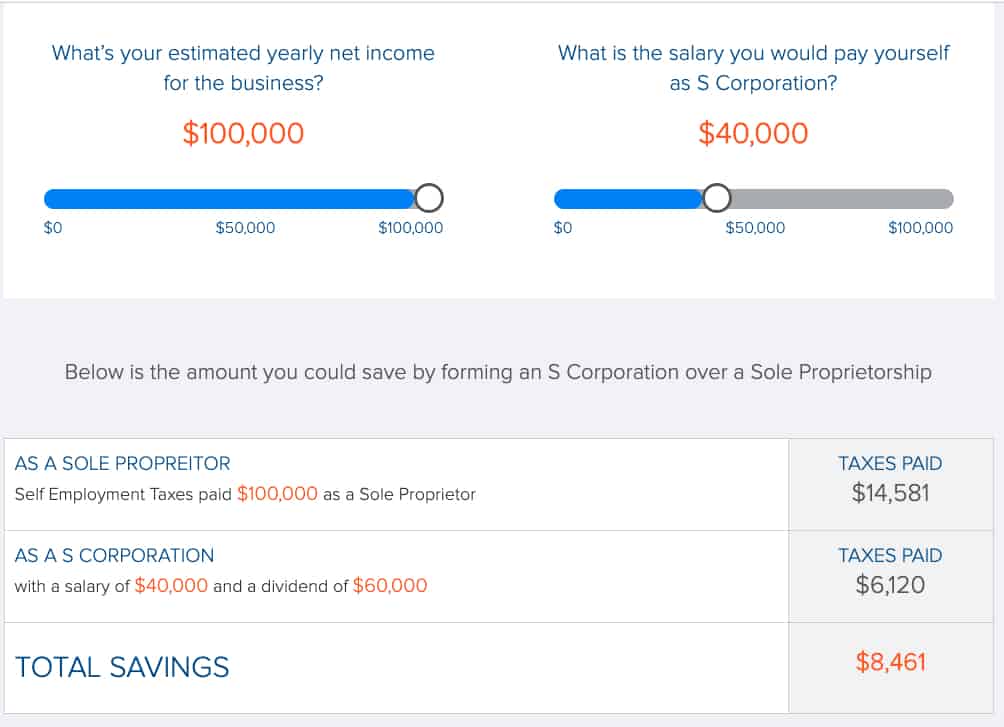

Finally, if your business had a net income of $100,000 for the year, and you paid yourself a salary of $40,000, you would save approximately $8,461 on self-employment taxes.

Want to run the numbers for yourself? Learn more about how setting up your LLC to file as an S Corp could help you save money on taxes with our S Corporation Tax Calculator.

How to Set Your Salary as an LLC Owner

There are a few complexities involved with setting up your LLC to file as an S Corporation. For example, you will want to decide what salary to pay yourself as the business owner, and how much of your business income you can designate as a “distribution” for tax purposes.

Generally, your salary must be set at a level that is competitive with reasonable market rates for what it costs to hire a full-time employee in a particular field. If you try to get away with paying yourself an ultra-low salary in order to avoid self-employment tax, this could draw scrutiny from the IRS. Talk to a tax professional for advice on how to optimize your business for tax purposes.

Another consideration when minimizing your self-employment taxes is that you might also be (indirectly) minimizing your contributions to your own future Social Security benefits in retirement, compared to what you would have contributed if you were an employee. Make sure to save extra money for retirement as part of your overall financial plans.